Trading in equity is smarter and more convenient with added facilities which enable you to select the right products.

Intra-day Trading

- Intraday trading allows traders to buy and sell stocks within the same trading day

- Stocks are purchased to earn profit from price movement on the same day, not to hold for the next day.

- Key Features

- Same Day Trading – Buying and selling of stocks happens on the same day.

- No Overnight Holding – All positions are closed before market closing time.

- Short-Term Profit – Traders aim to earn profit from small price movements.

- High Liquidity Stocks – Usually traded in stocks with high trading volume.

- Use of Margin – Brokers may provide extra margin to trade with more capital.

- High Risk & High Return – Possibility of quick profit but also quick loss.

- Technical Analysis – Charts, indicators, and patterns are used for decisions.

- Fast Decision Making – Traders must respond quickly to market changes.

- Stop Loss & Target – Used to control losses and secure profits.

- Market Timing – Correct entry and exit timing is very important.

Cover Order

- A Cover Order (CO) is a type of order where a trader places a market or limit order along with a mandatory stop-loss order. It helps limit potential losses and allows traders to use higher leverage provided by the broker.

Key Features

- 🛡️ Mandatory Stop-Loss – A stop-loss order must be placed to limit losses.

- ⚡ Higher Leverage – Brokers provide higher margin for trading.

- 📉 Risk Control – Helps manage and reduce trading risk.

- ⏱️ Intraday Only – Positions must be closed within the same trading day.

- 🎯 Better Capital Usage – Traders can trade with less capital due to leverage.

- 🔄 Automatic Square-Off – If not closed, the broker may square off the position before market close.

Cash Order

- Cash Order: Buying or selling shares using your own money, and the shares come to your Demat account.

- Cash Trading: The buying and selling of shares for delivery, where the buyer becomes the owner of the shares.

Key Features

- Use Your Own Money – Shares are bought using your own funds with full payment.

- Delivery to Demat Account – Shares are delivered and credited to your Demat account.

- Ownership of Shares – The buyer becomes the full owner of the shares.

- No Leverage or Margin – No borrowed money from the broker is used.

- Lower Risk Investment – Safer compared to intraday or margin trading.

- T+1 Settlement & Long-Term Holding – Shares are settled the next day and can be held for long-term investment..

Margin Order

- Buy Stocks Pay Later (BSPL) is a Margin Trading Facility (MTF) that allows investors to buy more stocks with a small initial capital, while the remaining amount is funded by the broker and paid later in instalments.

- With BSPL, you can get up to 4× leverage and hold stocks for up to 275 trading days, giving you higher buying power and the potential to increase profits..

Key Feature

- Partial Payment Facility: You only pay a small margin amount, not the full price of the stock.

- Higher Exposure: You can buy more stocks than your actual money.

- Leverage Benefit: The broker gives extra funds based on the allowed margin.

- Used in Equity Trading: Mostly used in the cash segment for short-term or positional trades.

- Mark-to-Market (MTM): Your trade is checked daily, and if there is a loss, you may need to add more margin money.

E-Margin Order

- E-Margin Order allows investors to buy stocks by paying only a part of the total amount (margin) instead of the full value.

- The broker funds the remaining amount, giving traders higher buying power and time to pay later.

- Investors can hold the stocks for a longer period (up to around T+275 days) by maintaining the required margin.

- It is mainly used for positional trading in the equity cash segment.

Key Features

- 💰 Partial Payment – Pay only a small margin instead of the full stock price.

- 📈 Higher Buying Power – Buy more stocks than your available capital.

- 🤝 Broker Funding – The broker funds the remaining amount of the trade.

- ⏳ Longer Holding Period – Stocks can be held for an extended time (up to around T+275 days).

- 🔄 Daily MTM Check – Positions are checked daily and losses may require extra margin.

- 🚀 Profit Opportunity – Higher exposure can increase profit potential (with higher risk).

Trade Smart

- Trade Smart means trading in a careful and planned way. It focuses on managing risk, making smart decisions, and staying consistent, instead of guessing or gambling. The goal is to protect your money and earn steady profits with a proper trading plan.

- Key Principles of Trading Smart

- Have a Trading Plan – Always trade with a clear strategy instead of guessing.

- Risk Management – Invest only a small part of your money in one trade to avoid big losses.

- Do Proper Research – Study the market, company, and price trends before trading.

- Control Emotions – Do not make decisions based on fear or greed.

- Set Stop Loss – Use stop-loss orders to limit losses if the price moves against you.

- Be Consistent – Follow your strategy regularly for better long-term results.

- Learn and Improve – Keep learning from your trades and market experience.

Derivatives

Derivatives are financial contracts whose value depends on another asset.

That asset can be stocks, index, commodities, bullion or currency.

For example:

If there is a derivative of ITC share, its value will change according to the price of ITC share in the market.

In derivatives trading, you trade the contract, not the actual stock or asset.

Equity Derivatives

Equity derivatives are contracts whose value comes from equity assets like stocks or stock indices.

The most common equity derivatives are:

- Futures

- Options

People trade equity derivatives to:

Speculate (try to earn profit from price movements)

Hedge risk (protect their investments)

Common Types of Derivatives

1. Futures

A futures contract means the buyer and seller must buy or sell the asset at a fixed price on a fixed future date.

The rules and contract size are standardized by the exchange.

2. Forward

A forward contract is similar to futures, but the terms can be customized between the buyer and seller.

These contracts are usually done privately between two parties.

3. Options

In options trading, the buyer has the right but not the obligation to buy or sell an asset at a fixed price before a certain date.

4. Swap

A swap is an agreement where two parties exchange cash flows or financial payments over time.

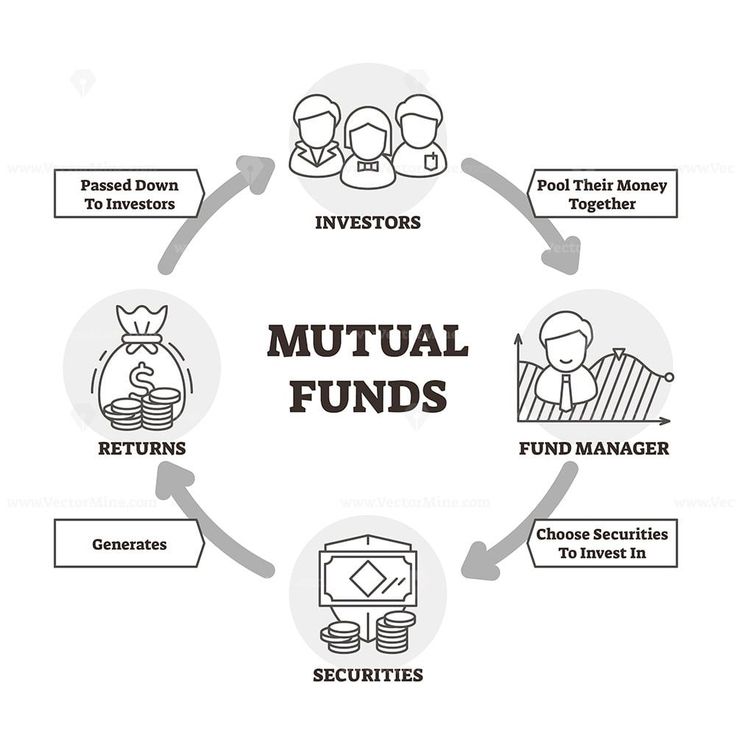

Mutual Funds are investments where money from many investors is collected and invested in assets like stocks, bonds, and government securities by professional fund managers to reduce risk and earn returns.

Key Features of Mutual Fund

Pooled Investment – Money from many investors is collected and invested together.

Professional Management – Experienced fund managers manage and invest the money.

Diversification – Money is invested in different assets like stocks, bonds, and securities to reduce risk.

Affordable Investment – You can start investing with a small amount of money.

Liquidity – Investors can usually buy or redeem units easily.

Regulated Investment – Mutual funds are regulated by Securities and Exchange Board of India (SEBI) for investor protection.

Transparency – Investors receive regular updates about fund performance and holdings.

How Would you Like to Start?

Start Investing From Best Pick Funds

Asset Type

There are various types of mutual funds which can be broadly classified based on their structure, asset class, and investment objectives. Additionally, they can be further segmented based on the investors’ risk appetite.

- Currency Derivatives are contracts between the buyer and seller that two currencies would be exchanged at a future date, at a stipulated rate.

- This segment offers an opportunity for retail investors to trade in the currency market.

- An Initial Public Offering or IPO is when equity shares of a company are offered to the public on the open market i.e. the stock market for the first time.

- The company going public raises capital and funds by trading IPO shares. During the IPO trading, a fraction of shares are reserved for different types of investors including Individual investors, Qualified Institutional Buyers and High Net-worth Individuals.

- The IPO is either a Fixed Price Issue or Book Built Issue.

- Commodities are physical product that has some commercial value and which can be traded —bought, sold, produced or consumed.

- Domestic regulated Commodity Exchanges offer standardized commodity contracts in which one can diversify their portfolio and hedge against risk.